Ant Financial is not a financial company. It is a technology company with an Intelligent Platform. To reflect this, it recently changed its name to Ant Group.

Ant Group has succeeded because of the platform business model creating network effects, AI, and courage to leap into new domains.

Ant Group has 1,3 billion users for its Alipay payment service. It also offers wealth management, loans to businesses, and insurance. Recently, it started to provide its technology for other banks.

All of this has made it one of the most successful fintech companies. As a result, it’s planning a ‘monster’ 200 billion-dollar IPO.

Ant has succeeded with a simple recipe. It started with a narrow focus on a strong core. It removes friction from processes within the core. Thus, it helps its customers to do things better. In so doing, it has gained a critical mass for its services. And it has been able to leverage this mass in multiple ways.

Actually, it has created a new way of thinking about business.

Like Facebook, Amazon, and Tesla, Ant Group is transcending industry boundaries with its Intelligent Platform. Intelligent Platforms generate network effects and have an AI-powered learning loop. Besides, they leverage human intelligence for unexpected leaps expanding their offering.

In this blog post, you’ll learn

- about Ant Group’s business;

- what is Intelligent Platform;

- about Ant Group strategy to build Intelligent Platform;

- 5 steps how Ant developed its Intelligent Platform;

- how you can get ahead of the game and evolve your company into an Intelligent Platform.

Ant businesses connect tightly through its platform

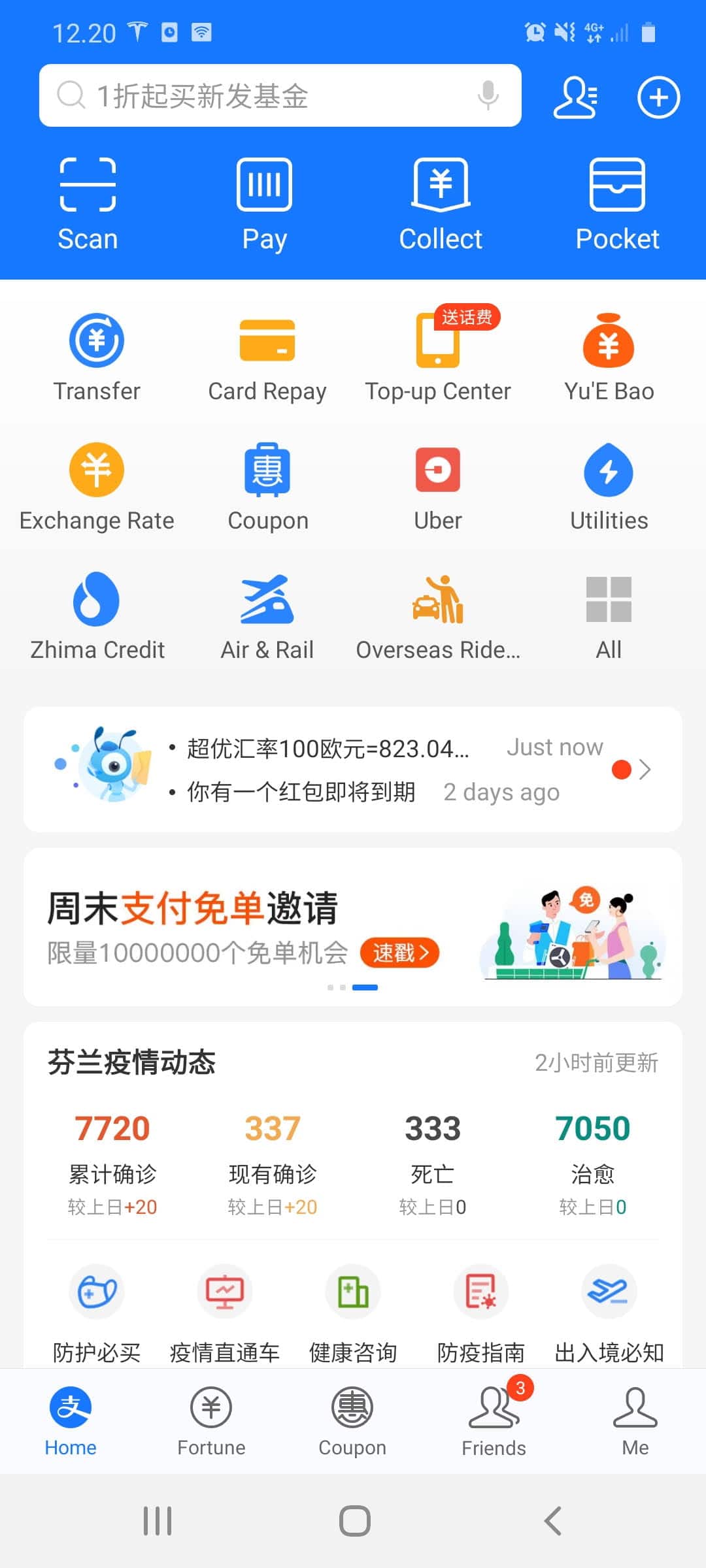

Ant Financial offers payments, wealth management, and micro-financing services. Furthermore, it provides insurances and credit scoring. Its services connect to the Alipay app. Alipay serves as a common platform. Ant Financial’s services include:

- Alipay – a mobile payment platform. It offers an e-wallet and payment app. It serves about 1.3 billion users worldwide, together with its global e-wallet partners.

- Yu’E Bao – a spare cash management platform. A user transfers money to Yu’E Bao. Then, it invests the money into a money market fund. In 2019, Yu’E Bao was the largest money market fund in the world.

- Huabei (Ant Credit Pay) – a virtual credit card service.

- Jiebei (Ant Cash Now) – a consumer loan service.

- Ant Fortune – a wealth management platform.

- Zhima Credit – a credit assessment service. A user with a higher Zhima Credit score enjoys various benefits. These include deposit waivers when renting a bike or staying at a hotel.

- MYBank – an on-line bank without physical branches. It serves small and micro businesses (SMEs). Its “310 lending model” enables loan applications in three minutes and approval in one second. All without human intervention.

- Xiang Hu Bao (“mutual protection”) – a basic health plan. It protects participants against 100 critical illnesses. These include breast cancer, lung cancer, and brain injury. There is no upfront payment. However, all participants bear the related expenses collectively.

- Ant Financial Cloud – a cloud service for financial institutions.

Ant platform leverages network effects, AI and human insight

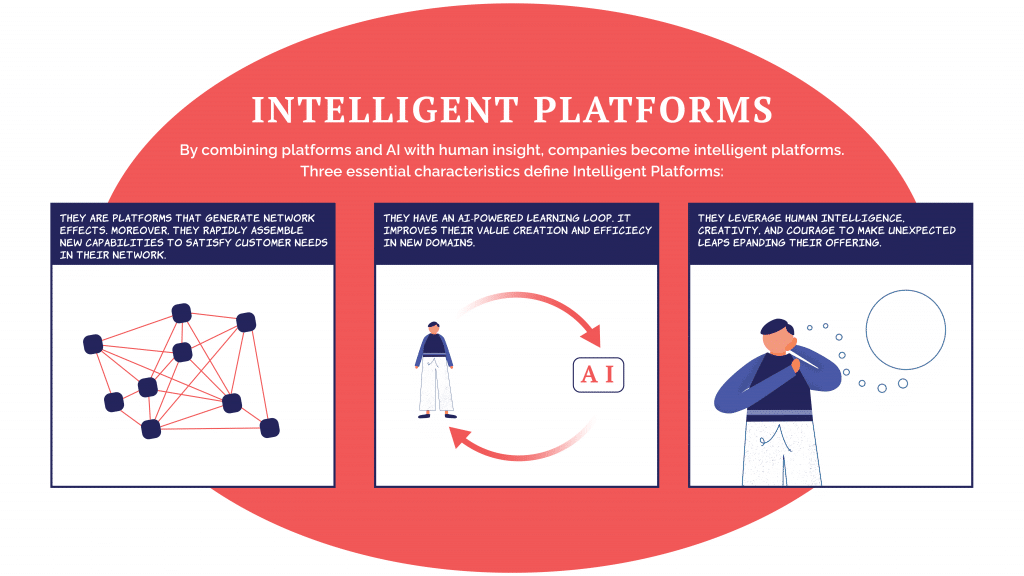

By combining platforms and AI with human insight, companies become intelligent platforms. Three essential characteristics define Intelligent Platforms:

- They are platforms that generate network effects. Moreover, they rapidly assemble new capabilities to satisfy customer needs in their network. Alipay is the centerpiece of this strategy. It is the platform to build new capabilities

- They have an AI-powered learning loop. It improves their value creation and efficiency in new domains. Ant Financial employs machine learning, computer vision, natural language processing. With these and mountains of data, it reimagines banking, insurance, and more.

- They leverage human intelligence, creativity, and courage to make unexpected leaps expanding their offering. Beyond financial services, Ant Financial is expanding to new areas. For example, cloud services, health insurance, and lifestyle services.

Ant Group’s platform is built on network effects

Ant Group services become more valuable as usage increases. This is called the network effect.

For example, friends can easily split a bill with Alipay. They use the money transfer chat feature. Hence, if your friends use Alipay, it encourages you to use it as well. And if you join, it adds value to other users. Or the more merchants Alipay has, the more likely consumers download the app. And vice versa, the large user base attracts more merchants.

Kickstarting network effects is hard. It is a chicken-egg problem. Alibaba is Ant’s parent company. Initially, it launched Alipay as an escrow service for the Alibaba’s marketplace Taobao. Taobao already had a significant user base. Thus, critical mass was secured early on.

Ant has expanded its business with five simple but smart steps.

Step 1: Remove friction to accelerate your platform growth

Alipay is the core service of Ant Group. As said, Alipay started as an escrow service for Alibaba’s marketplace. Alipay withheld the money until a buyer received the purchased goods. Thus, it improved the trust within the seller and the buyer. Lack of confidence created friction in the market, which Alipay removed.

Similarly, there was high friction in off-line commerce in China. The credit card system was not as developed as in western countries. To remove this friction, Ant introduced Alipay QR code payments. Thus, consumers paid by scanning a QR code provided by the merchant.

Ant Group has continued to identify high friction services and focused on helping the customers.

In economic terms, Ant reduces transaction costs for its users. Services are easier to access, i.e., there are smaller direct transaction costs. Furthermore, services are easier to find, reducing search costs.

And as it increases trust, opportunism-related transaction costs decrease. Opportunism related transaction costs result from the need to ensure that the transaction partner does what was agreed.

Step 2: Scale from niche – focus to create fans

To create strong network effects, a service should achieve high engagement and usage. A large number of unengaged customers won’t cut it.

Often companies start to expand their core service too fast. They pile new features that confuse the customer. And thus fail to build engagement before scaling.

Alipay created simple core interactions. First, it was settling payments between buyers and shoppers. Then, it created QR code payments. Thus, it secured a critical mass for its on-line payment platform. After that, it expanded the offering to related financial services like Ant Credit Pay, Ant Cash Now, and Ant Fortune.

And to create strong network effects, all of these services are part of the Alipay app. Like the spare cash management platform within the Alipay app. Or when an Ant Health Plan participant makes a claim, supporting evidence must be submitted via the Alipay app.

Step 3: Learn faster than the competition with AI

Intelligent Platforms have an AI-powered learning loop. It improves their value creation and efficiency in new domains. Leveraging their platform skills, they enter new industries. With the help of AI, they “run” faster than the incumbents or other entrants. Thus, they deliver more value than others.

Alipay captures the data on how consumers use the app. This data trains its AI to create a more personal experience. It also lets merchants know where users are. And hence the merchants can notify Alipay users of nearby services, with deals and coupons.

Thus, AI enhances the current service. In addition, it provides insights into what people would like to do with it. And what services Ant Financial could deliver going forward.

With its 1,3 billion users, hardly any company has access to the same amount of data. Therefore, Alipay learns faster than others. It attracts more customers and leaves competitors behind.

Ant Group leverages AI for many use cases

Ant Group has developed refined skills in AI. It uses machine learning, computer vision, and natural language processing. It applies them to many use cases. As these use cases scale up, they amplify Ant’s skills to predict and decide.

The more insurance claims it processes, the better it gets. The more customer questions it answers, the better it answers the next one.

To build a learning loop, you need to eliminate silos. Therefore, Ant developed a unified digital core. With it, AI can analyze large amounts of data from various sources. This prevents fraud in cashing loans or buying medical insurance with hidden diseases.

Risk and fraud detection

Ant has an AI-powered risk engine AlphaRisk. It offers real-time risk detection and management. Hence, it analyzes fraud attempts and patterns. Based on them, it adjusts risk profiles and takes actions on the fly. Furthermore, it uses advanced AI techniques like anomaly detection. Using them, it detects new fraud patterns and intervenes.

Ant is also using AI to detect fraud in medical insurances. Advanced neural networks provide powerful learning skills. They predict fraud in buying medical insurance with hidden diseases. Again, new data improves the performance of the system. We call this a learning loop.

AI based car insurance claim processing

Ant Insurance processes car insurance claims with the help of computer vision-basedAI. You take a photo and file an insurance claim through Alipay. The AI-based system uses an image recognition system that will analyze the case and processes it accordingly.

The more data it processes, the better it gets. New data continuously trains the AI. The human-machine collaboration further amplifies AI’s capabilities. If AI does not recognize a defect, a human will process it. After that, the system feeds data back to the AI system.

AI based health insurance processing

Similarly, users upload health insurance claims through Alipay. Natural language processing and health knowledge graphs understand the meanings of the information. Knowledge Graphs incorporates human expertise for making meaningful decisions. Furthermore, it brings context to AI applications. With the knowledge graph, the AI system extracts entities like hospital, disease, department, surgery, and insurance products. Thereafter, it performs real-time reasoning for the insurance claim.

Step 4: Evolve the platform by assembling new capabilities to satisfy your customers

Platforms by definition help different parties to interact. As platforms evolve, they assemble rapidly new capabilities by adding “sides.” For example, Alipay started as a two-sided platform. It connected buyers and sellers in the Taobao marketplace.

Then it connected consumers and merchants and banks through a payment system. In Alipay, the user’s account is connected to a bank account. Hence, the user can transfer money or deposit money into the Alipay account. Therefore, the more banks Alipay links to its platform, the more valuable it is to both merchants and consumers.

First, Ant established Alipay as a consumer payment service. It developed capabilities to assess consumer credit risks. But, the same risk assessment applied also to enterprises. Thus, expanded the platform into microfinance to small and medium-sized enterprises (SMEs).

The loan service made the platform even more attractive for banks. It expanded their market access. So, they could serve a much larger number of SMEs.

Similar to other platforms, Alipay has extensive APIs. For example, payments API allows merchants to integrate Alipay’s payment capabilities.

Step 5: Open up the platform and turn competitors into partners

First, Ant honed its technology with its own financial services. Then, it offered banking services through its cloud to banks. For example, Ant helped the Bank of Nanjing build a cloud-based finance arm. Among other services, it provides insurance and lending.

It also launched a Software-as-a-Service (SaaS) version of its technology product OceanBase. It is a financial-grade distributed relational database that has been a critical computing infrastructure for Alipay since 2010.

Over 100 banks, 60 insurers, and 40 wealth management companies and security brokerages use Ant Group’s cloud services. It aims to work with 1,000 banks by the end of 2020. In effect, this would be about a quarter of the banking institutions in China.

Ant Group expects more than half of its revenue to come from technology services in 2020.

Investing to accelerate technology adoption

Ant Group has pushed aggressively its technology to foreign markets. It has made several investments to accelerate adoption of its technology. For example,

- Kakao Pay, payment service of Kakao, Korea’s dominant messaging service;

- Paytm in India, the 4th largest digital wallet in the world by users;

- Swedish payments platform Klarna;

- GCash, payment and cross-border blockchain for the Philippines;

- Lazada (and digital wallet Dana) in Indonesia.

Ant also acquired the British international money transfer services provider WorldFirst for 700 million dollars.

Alipay becomes a Super App

First, Ant established a strong foundation in one vertical, financial services. After that, it expanded into new industry domains. Alipay builds a “one-stop digital lifestyle platform” that connects 40 million service providers with its users. For example, grocery-delivery companies, hotels, and transportation providers

Ant taps into every single aspect of our lives through a single app, a Super App. You already signed into everything and payment information is readily stored. Therefore, the app provides seamless access to all services. Hence, there is no need to reinput any info.

Key learnings from this post

The leading companies are thinking about strategy in a new way. It’s not about choosing an optimal position and sticking to it. Instead, it is about transcending industry boundaries in novel ways. Paradoxically, such transcending starts from a narrow focus. Focus builds a strong core that can be leveraged in multiple ways. Ant Group used the following five steps:

- Remove friction to accelerate your platform growth (make mundane things easier for your customers);

- Scale from niche – focus on creating fans to create strong network effects (control your temptation to jump into new domains too rapidly);

- Use AI to learn faster than the competition (every new transaction gives you data on how to improve);

- Assemble new capabilities via your platform to satisfy your customers (once you have them hooked to your core, you can sell them more);

- Open up and turn competitors into partners (once you have a winning platform, others want to operate on the platform).

One Response